Blogs

Although not, when it is the customer just who terminates the order, the brand new Serious Cash is generally granted to your supplier. In every things, the newest go back of your own Earnest Cash is governed by bargain between your buyer and you may seller. Alexy joined industry using a strategy possibly called “house hacking.” The word is actually created from the BiggerPockets, an internet investment for real property traders. They basically function you’re also occupying forget the property both by the renting out rooms, since the Alexy did, otherwise leasing aside equipment out of an establishing.

Without lowest credit history conditions and you can a focus on advantage-dependent financing, we unlock the entranceway to help you possibilities you to definitely traditional financing options you’ll exit signed. Demand is actually subsequent increased from the advantageous rate of exchange, residence programs, and financing-amicable legislation in a number of countries. Much more about people are looking for financing services, pied-a-terres, and second houses you to combine luxury, location, and you may funding progress possible.

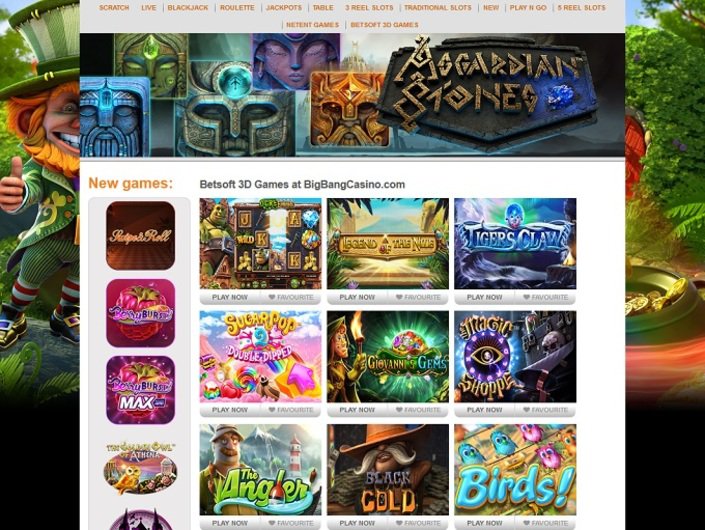

Casino Wild Dice: *Offer requires 1 minute, no credit pull

Meanwhile, short-term rental people try seeing strong consult, with 57% claiming the features are typically vacant casino Wild Dice lower than two weeks ranging from stays, when you are more 1 in 3 respondents (39%) say its typical vacancies is actually under a week. Extremely people got the look to build wide range and you will monetary security (41%), because they appreciate a property (40%), or perhaps to make inactive earnings (39%). Ahead of applying for a genuine currency internet casino, consider your needs.

Difficult Money Home-based Money: Small Investment the real deal House Buyers and you will House Flippers

Depending on the code, the brand new “revealing individual” ‘s the individual carrying out the new payment/closing or perhaps the individual that prepares the fresh payment report. Reporting can be’t be prevented in case your consumer chooses to not pick label insurance rates. If you’re also aspiring to pick a property — definition you’re also in the market for certain domestic a home — it’s smart to focus on a talented regional actual home broker. A real estate agent you never know your neighborhood really makes it possible to discover house one to meet your needs and you will browse the purchase processes efficiently. Asking loved ones and you may members of the family to own ideas will be a undertaking part. Make sure you interview numerous agencies to discover the one who’s the best complement you.

Park Set Finance along with provides experienced traders, several of who getting repeat people. Customer recommendations define staff as basic to utilize and you may take pleasure in the fresh fast closing moments and you will advanced support service. SpeedClosing often takes seven so you can 10 business days once you’lso are eliminated to close off by your name business and you can discovered your own assessment report.

What are Tough Currency Home-based Fund?

Such as, lender statements appearing exchangeability may help make faith to the bank. Qualifying to possess a challenging money residential mortgage targets the benefits of the house you’re having fun with as the equity as opposed to your credit history. Difficult currency loan providers focus on the new property’s potential to make efficiency. Fulfilling their demands ensures shorter acceptance for those short-term money options. Filling out a hill out of paperwork and you can getting many files is actually tend to popular requirements to own getting a bona fide home financing from an excellent lender. Since the Ca hard currency lenders are primarily asset-based, they concentrate on the value of the property and the debtor’s equity (downpayment) regarding the possessions.

Just how can Guidehouse Assist A house Companies and Financial institution

Because of the bringing this type of parties together, you’ve cut out the necessity to go trying to find a purchaser after you’ve joined an agreement. Rather, because of the finding the vendors as well as the customers ahead of time, it is possible to get into an agreement to the confidence you to definitely you obtained’t get trapped being required to romantic escrow to the possessions. The majority of people believe that it’s easier to make money online than it is and then make significant coin inside the a home. Should you get the brand new lay of the home and you will comprehend the highway submit, you may make strides. Your wear’t you desire a lot of doing money to generate income inside the real property world. The guy lived-in a bathroom to possess a year along with his father as he is several yrs . old.

Yet not, he could be responsive to interest rates and you will monetary cycles, thus investors will be evaluate their chance threshold and you can financing requirements. Looking to spend money on a property but not yes simple tips to safer funding for multiple rental functions? Owning a home trusts try companies that own and you may manage multiple income-promoting characteristics. They have a tendency to work within the industrial functions, such malls, workplaces, and healthcare facilities. You could turn bare bed room yourself possessions on the local rental room called accessory hold equipment.

This will likely work effectively if the housing market is hiking since you’re creating a pre-place price where you might after purchase the possessions. Home investing works on the thought of cash flow, so that your earnings must exceed their outbound costs. This will benefit one another a lot of time-label residential and you can commercial apartments, and it does benefit small-identity vacation rentals.

Show Home Feel

Really deals having supplier or friendly financing, and many low-old-fashioned lending, should be advertised, as the have a tendency to most transfers in order to a subsidiary otherwise connected team. Presumably, transfers from guarantee interests inside agencies you to definitely individual real estate create getting handled under the CTA. Since the hard currency money make use of the property as the equity, tough money lenders tend to provide quicker money than just antique fund. This way, when the a debtor defaults, the lending company can frequently recapture the borrowed funds investment—and perhaps more—by the selling the property. In addition to, requiring a much bigger downpayment from the debtor best covers the new financial against field action.

“The big gray urban area here is how often consumer broker income end up being managed moving on,” said Cobreiro, because there isn’t any signed contract yet , one to demonstrably suggests exactly how and that is addressed. As the suggested, the brand new payment would have the brand new NAR totally lose commissions from the Mls program from the July. “The newest laws which was the topic of litigation demands simply one to number brokers share a deal of compensation,” the brand new NAR wrote inside a news release. To do so, you should be in a position to identify both empty house otherwise property that will be behind to their mortgages. You’lso are effortlessly searching for upset providers, however, belongings that are currently unused are primed for the possibility like this. Ian Gary, government director of your Truth Coalition, an excellent nonprofit you to encourages business transparency, called the regulations “much-needed protection” from the fight filthy profit the newest You.S.